🗣 SL提问: ESG300ETF

✍️ Ai批改: It seems like you're referring to a specific Exchange-Traded Fund (ETF) with the ticker symbol ESG300、However, without more context, it's challenging to provide detailed information about this particular ETF、ETFs are investment funds that are traded on a stock exchange, like individual stocks, and they can track a wide range of assets, including indexes, sectors, commodities, or a basket of securities that meet certain criteria.

If ESG300 refers to a specific ETF, here are a few general things you might want to know or consider:

1、Understanding ESG: ESG stands for Environmental, Social, and Governance、ESG-focused ETFs typically invest in companies that demonstrate strong performance in these three areas、They are designed for investors who want to align their investments with their values or who believe that companies with strong ESG performance may have better long-term financial performance.

2、The 300: Without a specific reference, it's hard to say what the 300 signifies、It could refer to the number of stocks in the index the ETF tracks, a specific index it follows (like the CSI 300, which is an index of the 300 largest and most liquid stocks listed on the Shanghai and Shenzhen stock exchanges), or another characteristic.

3、Investment Goals and Holdings: If you're considering investing in an ESG300 ETF, you would want to know its specific investment goals, holdings, fees, and the index it tracks、This information can help you understand the level of risk, the sectors and geographic regions it covers, and whether it aligns with your investment strategy and values.

4、Performance and Risks: Like any investment, past performance is not a guarantee of future results, and ETFs come with their own set of risks, including market risk, sector risk, and tracking risk (the risk that the ETF's performance may not match that of its underlying index).

5、How to Invest: You can buy and sell shares of ETFs through a brokerage account, similar to how you would buy and sell stocks.

To get more detailed information about a specific ESG300 ETF, including its investment objectives, risks, and holdings, I recommend:

Checking financial websites like Yahoo Finance, Bloomberg, or Morningstar.

Visiting the official website of the ETF provider (e.g., BlackRock's iShares, Vanguard, or State Street Global Advisors).

Consulting with a financial advisor if you're unsure about which investments are right for you.

If you have more details about the ETF, such as its provider or the specific index it tracks, I could offer more targeted information.

0

IP地址: 84.248.227.136

搜索次数: 225

提问时间: 2025-04-16 08:50:59

❓️ 热门提问:

你是不是ai

膨胀螺

黄金首饰行情走势图

ai绘画cad

菠萝黄金吊坠

ai 绘画获奖

5.28金价走势

黄金回收 合肥市

金港肥牛

国产珠宝品牌排行榜

豌豆Ai站群搜索引擎系统

🤝 关于我们:

三乐Ai

作文批改

英语分析

在线翻译

拍照识图

Ai提问

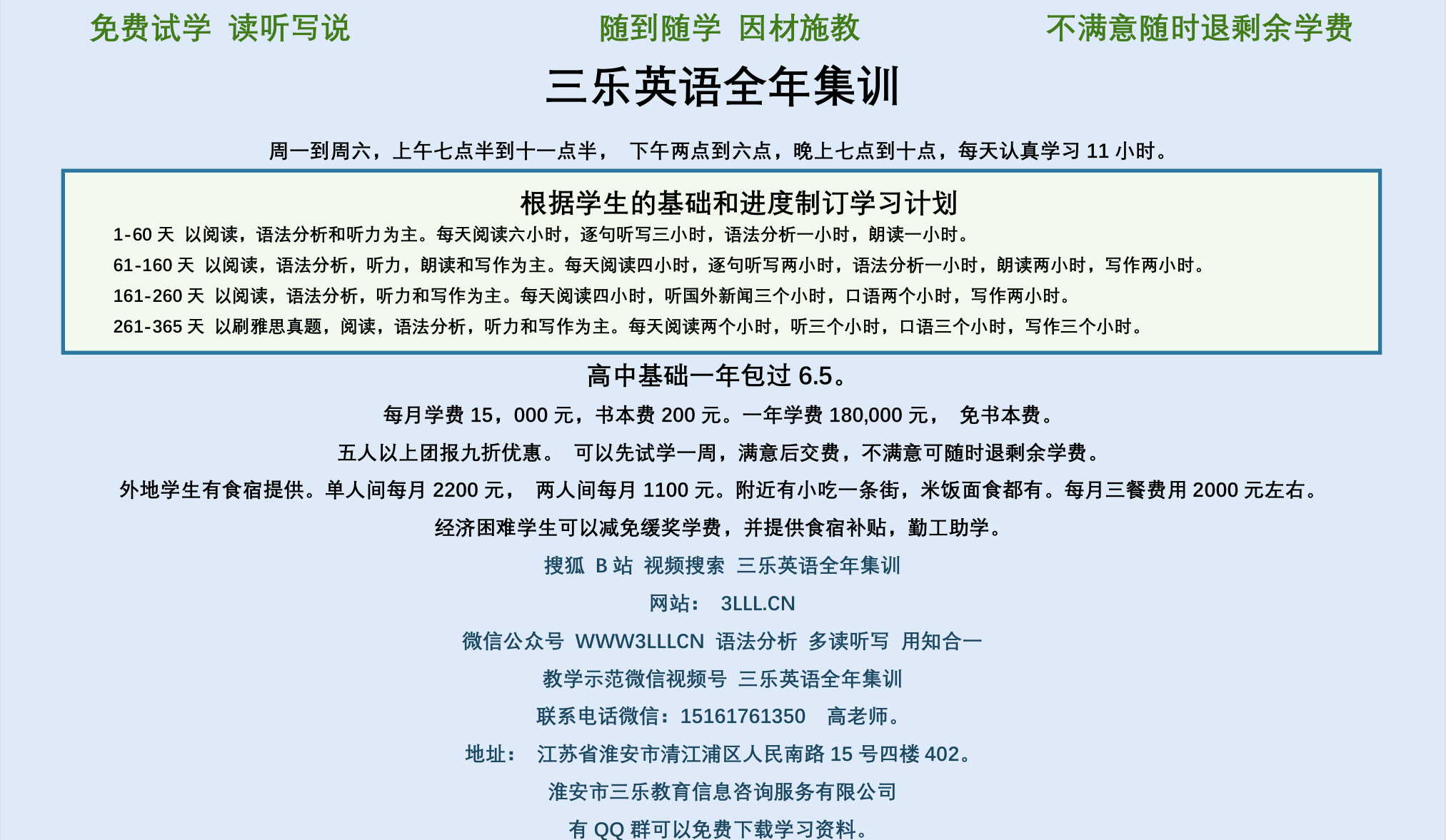

英语培训

本站流量

联系我们

📢 温馨提示:本站所有问答由Ai自动创作,内容仅供参考,若有误差请用“联系”里面信息通知我们人工修改或删除。

👉 技术支持:本站由豌豆Ai提供技术支持,使用的最新版:《豌豆Ai站群搜索引擎系统 V.25.05.20》搭建本站。